Call for Collaboration: Enhancing the enabling environment to accelerate the mobilisation of private finance for adaptation and resilience

The financial system has the potential to drive transformational change towards climate-resilient countries, communities, businesses, and natural ecosystems. A growing number of insurers, banks, and investors worldwide increasingly recognize the risks of inaction and the emerging opportunities related to adaptation and resilience. Private financial institutions today are investing in adaptation and resilience and implementing the necessary financial instruments, frameworks, and metrics. Yet action is incremental and requires the development of further enabling conditions for the nascent adaptation and resilience market.

This call for collaboration is also an offer from private financial institutions to policymakers to actively support the creation of the enabling environment to accelerate the growing efforts and further mobilise private finance for adaptation and resilience to where it is needed most.

The offer

To support this aim, private finance and supporting partners offer to:

- Identify the specific barriers, country-specific contexts, as well as financing and capacity, needs to further mobilise private finance locally, nationally, regionally, and globally and to contribute insights indicating specific actions required to scale up financing for adaptation and resilience.

- Share knowledge, data, best practices, and strategies to expand investments in adaptation and resilience with nature as an integral part of the solution.

- Ideate, pilot, and promote existing frameworks and taxonomies to encourage assessment of physical climate risks and resilience, protection from physical climate risks and investments into adaptation and resilience.

- Build capacity on financing adaptation and resilience with other private sector partners, policymakers, think tanks, NGOs, and philanthropy.

- Convene key actors inter alia philanthropy, public and private financial institutions, businesses, and civil society, and engage with governments to put in place appropriate investment plans for adaptation, backed by data and reflecting local needs.

The ask

In order to scale existing actions, innovations, and leadership on adaptation and resilience finance, private finance and supporting partners call on policymakers to:

- Integrate private finance into efforts to evolve the international financial architecture and global policy processes on adaptation and resilience including expanded discussions on adaptation and resilience in the multilateral discussions on Article 2.1.(c) of the Paris Agreement and the involvement of private finance into the delivery of adaptation and resilience planning and action including through National Adaptation Plans (NAPs).

- Develop policy frameworks that support efforts to 1) measure, address, and mitigate physical climate risks and quantify resilience benefits and 2) integrate adaptation and resilience metrics into financial decision-making processes.

- Build the enabling environments for incentivising adaptation and resilience action including data and tools to allow needs and investments to be identified and finance to flow.

- Support the development of adaptation finance markets in low- and middle-income economies through 1) the set-up of suitable enabling environments to facilitate flow of finance and support de-risking investments, 2) the enhanced provision of public finance for blended finance schemes for adaptation and resilience and 3) the set-up of technical assistance facilities where most needed.

- Enable the development of evidence through research on how adaptation and resilience solutions interact with gender, nature, health, climate mitigation and sustainable development in general to enable the private sector to leverage co-benefits in their strategies.

We need all hands on deck.

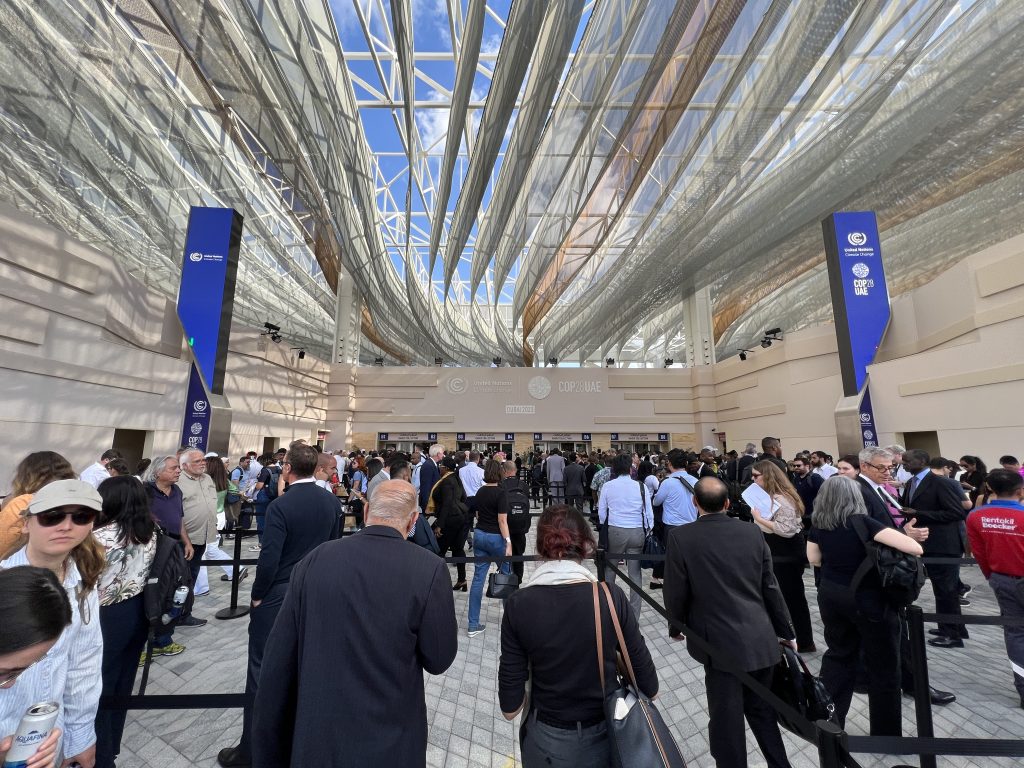

This call for collaboration was initiated in the context of private finance increasingly recognizing the urgency and opportunity to accelerate action on adaptation and resilience. Through a series of dialogues this year, private finance and country delegates from developed and developing countries shared experiences and exchanged knowledge to unite forces and enhance the enabling environment to accelerate the mobilisation of private finance for adaptation and resilience.

The call for collaboration is meant to initiate an open dialogue and invite further stakeholders and countries to join, form, and implement the aspects discussed in this document to COP28 and beyond.

The context: Channeling finance towards developing countries

The authors underline the importance of ongoing efforts to evolve the international financial architecture towards lowering the cost of capital for climate action, especially in developing countries. Some key challenges affect developing countries more acutely, limiting their access to public and private finance in general and substantially increasing their cost of capital. International Financial Institutions play a critical role in co-developing innovative instruments to catalyse private finance and reduce the cost of capital in developing countries. These instruments include inter alia, debt treatment instruments and effective risk mitigation approaches, which ultimately improve access, affordability, and availability of finance.

In order for global capital markets to channel finance to where it is needed and help build resilience by absorbing risks, information is needed to measure risks and prioritise adaptation solutions that address these risks in a targeted way. As such, the assessment of physical climate risks is an important underpinning condition of adaptation, to understand the existing baseline, invest in adaptation, and assess the resulting adaptation benefits.

For adaptation and resilience, several initiatives define this as addressing the ‘physical risks’ of climate change. However, assessment and disclosure of physical climate risks lag behind that of mitigation. This call for collaboration aims to expedite this, unlocking opportunities in financing adaptation and resilience.

Improving the accessibility and availability of physical climate risk and resilience information can bring significant wider benefits. Work to date has shown in developed and developing markets that infrastructure projects that have embedded climate resilience can offer better rates of return than those without. Furthermore, there are various financial institutions already integrating physical climate risks into their operations with a positive increase of innovative instruments to address vulnerabilities in a targeted way. It can also unlock financial innovations in blended finance and insurance that can help ensure a reduced cost of capital and access to funding for vulnerable communities, with leaders in the sector already working in this space.

Policy frameworks can incentivize addressing physical climate risks however this also needs to be supported by investments in comparable quality data as a public good to ensure information is available to all on a level playing field.

The benefits that can arise from addressing the above-mentioned private finance offers and policy asks:

- Enabling policies encourage innovation and scalability of adaptation and resilience solutions through e.g., government support for research and development, subsidies, tax incentives targeted at resilience and adaptation measures that have a risk reduction element, or procurement policies among others. Private sector involvement both at the local level and globally often drives innovation, leading to the development of new technologies and approaches that can be applied on a larger scale, ultimately enhancing the resilience of communities, businesses, infrastructure, and natural ecosystems.

- Knowledge and expertise sharing between the public and private sectors is a crucial component in building a mutual understanding of adaptation and resilience both in the public and private sectors.

- Development of new financial instruments to unlock the vast resources of capital markets towards adaptation and resilience with nature as an integral part of the solution. In developing countries, dedicated instruments for small- and medium enterprises are a priority due to their outstanding role in their domestic economies.

- Improved tracking will increase transparency in markets for adaptation, and the ability for local governments and investors to hold companies to account for their actions on adaptation and to incentivise greater and better action.

Signatories and authors

The government supporters who acknowledge this call for collaboration include: the Government of Austria, the Government of Chile, the Government of Colombia, the Government of Guatemala, and the Government of Switzerland.

The private finance, non-governmental organizations, and business signatories to the call to contribution include CAURIE MicroFinance, Climate Bonds Initiative, FINCA Perú, FSD Africa, Fundación Espoir, GAWA Capital, the Global Center on Adaptation, Global Resilience Partnership, IIED, the Lightsmith Group, Marsh McLennan, Microfinanciera Contactar Colombia, Raincoat, the Principles for Responsible Investment, and YAPU Solutions GmbH.

This Call for Collaboration was coordinated by the Insurance Development Forum (IDF), the Institutional Investors Group on Climate Change (IIGCC), the United Nations Environment Programme Finance Initiative (UNEP FI), the Adrienne Arsht-Rockefeller Foundation Resilience Center at the Atlantic Council (Arsht-Rock), the University of Oxford Environmental Change Institute, the University of Cambridge Institute for Sustainability Leadership, and the Asia Investor Group on Climate Change (AIGCC).

The Call for Collaboration was completed in collaboration with the UN Climate Change High-Level Champions.

The authors of the Call for Collaboration would also like to acknowledge Climate Bonds Initiative and ODI.